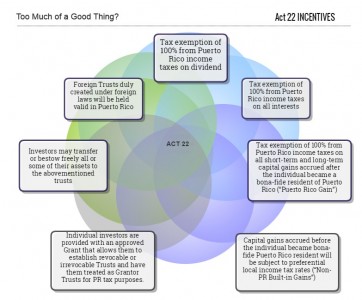

ACT NO. 22 OF JANUARY 17, 2012, AS AMENDED

To establish the “Act to Promote the Transfer of Individual Investors to Puerto Rico” with the objective

to grant tax exemption in regards to revenue, resulting from investments accrued by individuals

who are residents in Puerto Rico, no later than the end of year that finishes on December 31st, 2035.

The income of all earnings accrued by a Resident Individual Investor after becoming resident of

Puerto Rico before January 2036, consisting of interests and dividends including but not limited to

interests and dividends from of a investments registered company as described in Section 1112.01 of the

Code will be fully exempt of Puerto Rico income tax payments, including the alternate basic tax

provided in the Code. In addition, the income obtained by a Resident Individual Investor after becoming

resident of Puerto Rico before January 1st, 2036, that consists of interests, finance charges, dividends, or

participation in society benefits received from duly authorized international bank entities in accordance

with the Banking Center Act, will be fully exempt of income tax payments from Puerto Rico, including

the alternate basic tax provided in the Code.

Eligibility:

- Individuals must be present physically on the Island 183 days in the taxable year

- Cannot have a tax home outside of Puerto Rico

- Cannot have been residents in PR 6 years prior to the date in which Act became effective on January 12, 2012

- Cannot have a closer connection to United States or any other foreign country than to Puerto Rico

- Annual report with the Office of Insdustrial Tax Exemption due April 15th including evidence of compliance of conditions and requirements of the grant for taxable year immediately before the filing date of report.

- $5,000 fee is due upon the approval of any Grant under Law 22 in addition to fee due with filing of Grant application.

- To qualify for the Act 22 incentives, all gains must be recognized prior to January 1, 2036.

- New Amendments for Act 22 applicants that file for a tax incentives grant after December 1st, 2015:Acquire a residential property in the first 2 years since the date of the notification of residency.

- The presentation of the Deed of Purchase & Sale is mandatory.

Provide evidence of a bank account in a local financial institution.